The Challenge

Many eligible clients applying for benefits are required to submit documents to prove their eligibility and complete their application. Often clients are denied benefits they are eligible for because they do not submit their documents, or they submit incorrect documents. The Call Centers at Benefits Data Trust provide clients with a list of documents they need to submit along with basic instructions. Clients will often call back after their initial phone conversation and wait in the general queue for long periods of time to ask questions about their documents, such as ‘what qualifies as proof.’

As a result, I set out to solve the following challenges:

Research

Before deciding how to test solutions for these pain points, I spoke with clients, caseworkers and call center specialists to understand the challenges they face related to document submissions.

Findings from clients who applied for benefits:

Prefer to be helped by real people who are informed about benefits

Do not have time to wait on the phone to get answers to their questions

Like having reminders to submit their documents

Found document requirements confusing

Findings from call center specialists and case workers:

Most clients only have a couple of questions related to documents

Clients don’t use or don’t like using chatbots

Clients don’t always understand what the document requirements are

Client Journey:

In interviewing clients, I learned that the client’s journey without document assistance can end with frustration or confusion. Often resulting in their benefit application being denied, especially for those with complex document requirements.

To have a deeper understanding of why benefit applications are denied due to missing or incorrect document submissions, we analyzed application data and found that the most commonly denied applications for document reasons included the following document requirements:

Wage document requests

Clients with In-kind income

Proof of stopped working

Proof of management

Proof of immigration

The user research and data analysis led us to test and determine if:

Client-tailored document guidance through a live agent would reduce the number of clients denied due to missing documents?

Proactive outreach about post-application questions reduce post application calls?

Asynchronous conversations via text between a specialist and a client is an efficient (for specialists) and engaging (for clients) omnichannel approach?

Our Target Demographic would include:

SNAP, PTRR, and LIHEAP applicants

Clients who opted into text messages

Clients that have document requests, specifically focusing on wage doc requests, clients with In-kind income, Proof of stopped working, Proof of management, and Proof of immigration.

Solution

To test our hypothesis we designed a two-way live agent texting test. Three specialists used Bird (Formerly known as Messagebird) to conduct personalized outreach to a filtered list of clients and answered questions about complex documents via 2-way live agent text.

State: PA Channel: Live Agent Text Specialists: 3 Run Time: 5 Weeks 11/26-12/30

Outreach texts were sent to PA clients who:

Submitted benefit applications within the previous 2 weeks through BDT (Focusing on SNAP, PTRR, & LIHEAP benefits)

Opted into text messages and have been notified by text that their benefit application(s) have been submitted

Have document requests. Focusing on younger households with wage doc requests, clients with In-kind income, proof of stopped working, proof of management, proof of immigration.

Live Agent User Flow:

Impact + Findings

Improved Client Journey:

Survey results, comments from participants, and benefit enrollment data revealed an improved user journey with the addition of the live agent document assistance service. Clients were grateful for the text reminders, and reported a positive experience getting their document questions answered.

Although the sample size was small, the qualitative and quantitative data from the test suggests the live agent document assistance was successful. I found that:

PTRR applicants and SNAP applicants are more likely to need document assistance than LIHEAP applicants.

Applicants under 44 are more likely to engage over text (34% more likely).

Time spent talking on calls with texted clients post-application (15.1 mins) was less than the time spent with non-texted clients (20.5 mins), but a larger sample size would be needed to prove a statistically significant difference.

Clients seemed overall happy with the asynchronous texts. Of the clients who completed the survey, all said their experience was Very Good or Good.

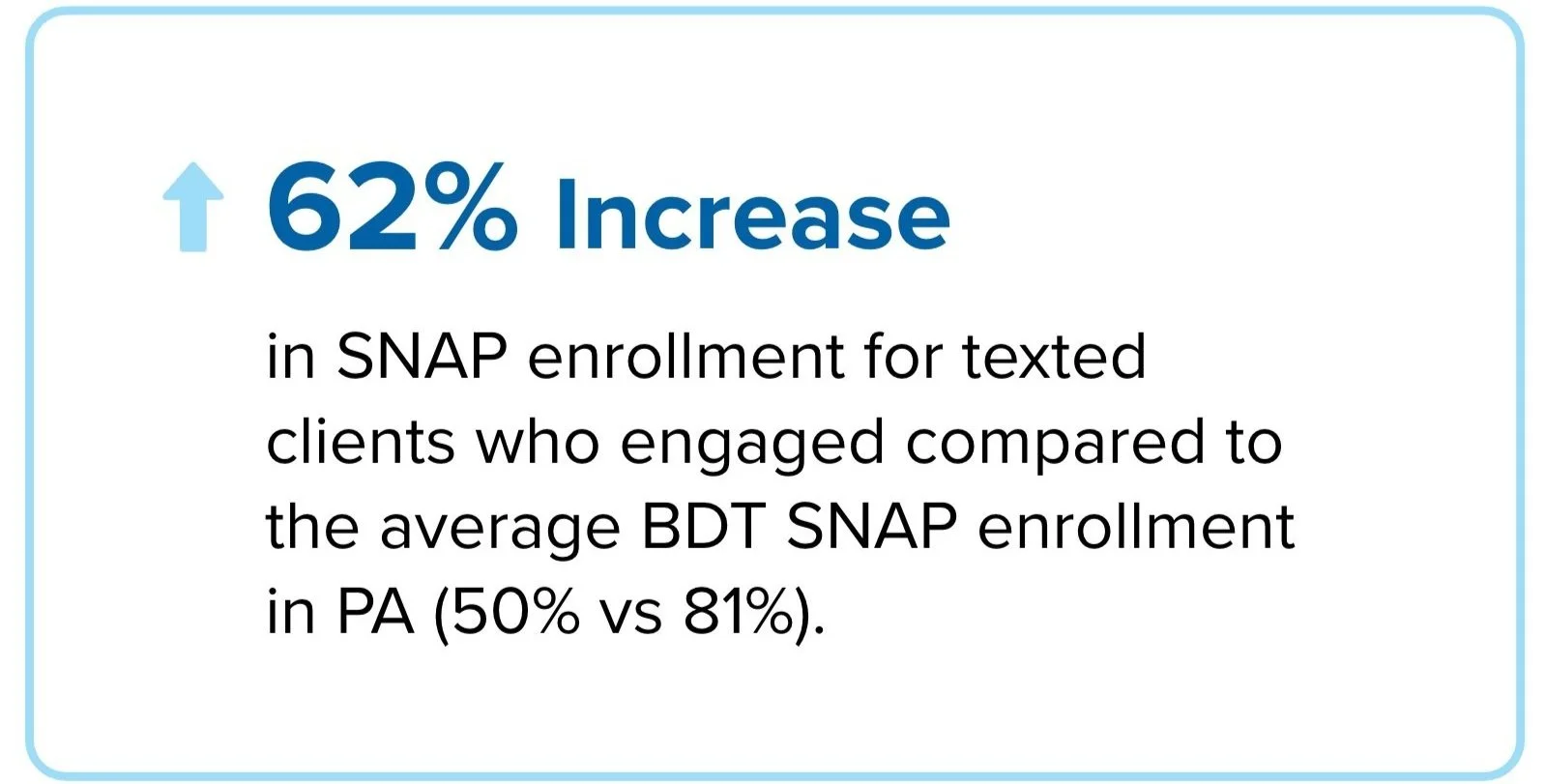

Most importantly, the data suggests an increase in enrollments due to the text reminders and assistance offered:

“I have been so overwhelmed by everything going on...thank you I appreciate your help.”

Recommendations

Even with the limited sample size, the results were strong and highlight that 2-way live agent texting could be an effective way to assist with document submissions. After reviewing the outcomes, the recommendation to BDT was to continue testing this service experience and iterate in the following ways to potentially make the service more automated:

Replicate this feature in other benefits and states

Use a larger sample size and therefore achieve more statistically significant results in future iterations

Determine if two-way texting reduces calls for clients with less complex document requests

Test similar methods to answer document questions

Consider creating a web-based FAQ or guide for clients to use to answer document related questions

Consider sending only reminder texts about submitting documents

Consider sending dynamic text messages with pre-programmed replies for clients to learn more about documents or get access to additional resources

In collaboration with Hardik Savalia and Marisa Diaz.